Mục lục:

Ponzi scheme is a form of fraud that is not too unfamiliar in digital and cryptocurrency. Equipping knowledge about this model to avoid falling into the trap is essential. Do you know what a Ponzi scheme is? How was it born, and what are the signs of fraud? In this article, Kienthuccoin will help you answer in detail.

What is Ponzi scheme?

What is a Ponzi scheme? Ponzi, Ponzi pattern or Ponzi scheme is often referred to as a “notorious” form of fraud and has been around for hundreds of years. This model is used in many different forms globally, and in Vietnam today, many organizations and individuals are using Ponzi to make illicit profits from investors.

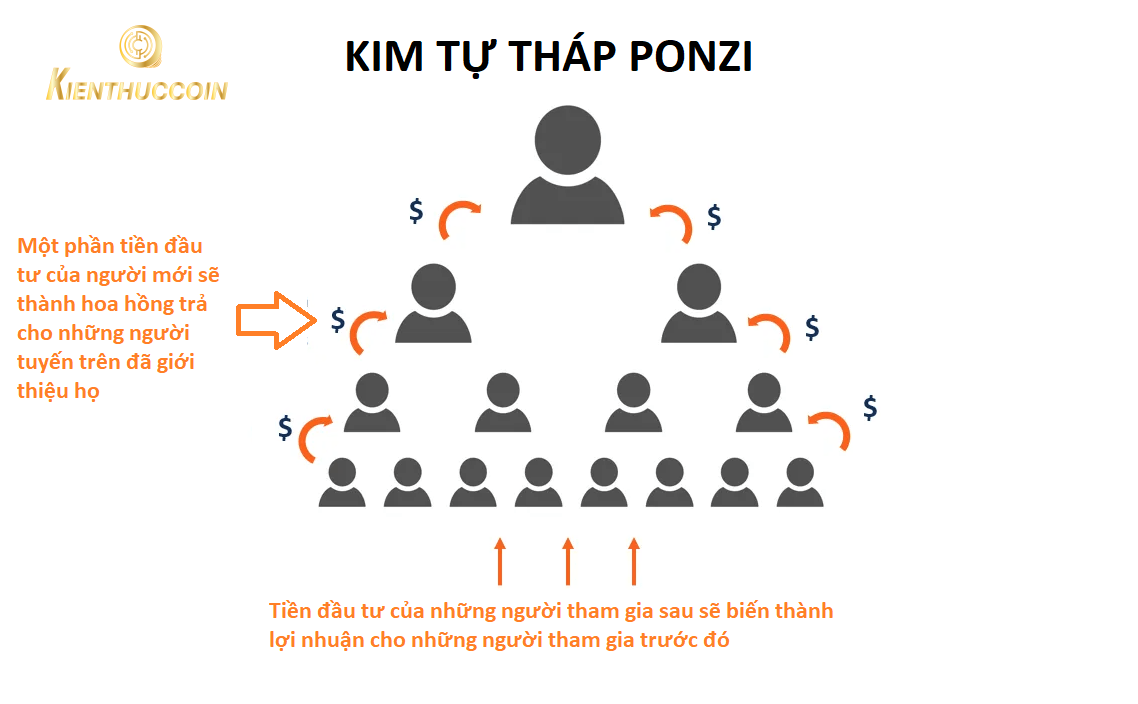

A Ponzi scheme is borrowing money from one person to repay another. Borrowers offer high-yield guarantees to lenders and advertise with them examples of past high-yield returns to attract lenders. Lenders attracted by high yields even refer newer lenders. In this way, borrowers are increasingly able to borrow more significant amounts of money from more new lenders. This model often requires, calls for, and entices participants to contribute capital to invest continuously.

Owners of Ponzi schemes often entice new investors by offering higher returns than other investments, with short-term returns that are either unusually high or unusually long.

Sometimes the Ponzi scheme starts as a legitimate business enterprise until the business fails to achieve the expected profits. The business continues to become a Ponzi scheme if it continues the fraudulent behavior.

This model collapses when many investors who have participated suddenly withdraw capital or are unable to call for new investors. Usually, in the Ponzi model, investors are invited to participate in investment projects with attractive interest rates and high return rates. Money invested or contributed capital instead of reinvesting to generate profit to pay interest. It is used to pay back the previous investor and does not have any profitable investment.

The origin of the Ponzi scheme

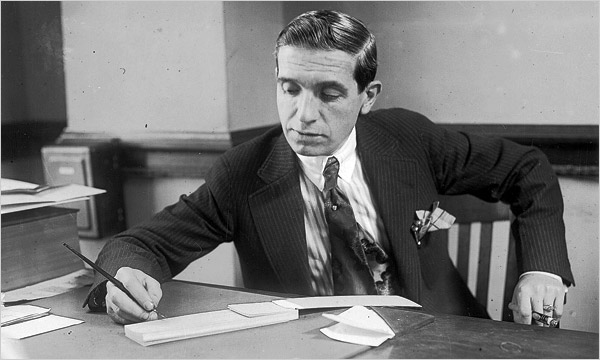

The scheme is named after the scammer Charles Ponzi or Carlo Ponzi (Italian pronunciation), famous for adopting the pattern in the 1920s. This Ponzi scheme is derived from the Martin Chuzzlewit novels. (1844) by Charles Dickens, but Ponzi implemented it in real life and made so much money that the model became famous throughout the United States. Ponzi's original plan was to use the international payment coupon to pay for the postage stamps, but then he used the money of latecomers to pay for himself and those who came first.

Origins of the Ponzi Model

The postal service at the time developed a universally discounted answer sheet that allowed mailers to pay postage in advance, including fees from respondents. Recipients can take the coupon to the local post office, exchange it for a postage stamp, and mail a reply.

The price of postage stamps is volatile, and in some countries, the cost of postage stamps is higher than in others. Ponzi hired many agents to buy coupons for postage stamps in cheap countries and send them to him. Then, he exchanged these coupons for postage stamps inexpensive places and sold them at a high profit.

This type of sale is technically called Arbitrage and is considered illegal. The Ponzi then becomes greedy and expands its efforts. Because of this “huge” revenue, Ponzi had money to establish a “Securities Exchange Company.” He promises a profit of 50% in 45 days and 100% in 90 days. Seeing him succeed in the field of stamps, investors were immediately attracted. However, instead of investing the money, Mr. Ponzi only brought it to pay interest to the old person and took the rest as profit. This scam model lasted until 1920 and collapsed due to an investigation into his company.

What are the telltale signs of a Ponzi scheme?

The largest Ponzi scheme to date is led by Berni Madoff, a Wall Street financial business magnate with several victims from many different countries with a loss of up to $65 billion USD. . In 2008, Bernard Madoff was accused of using a Ponzi scheme to generate fake trading reports to prove to investors that his investment fund was highly profitable.

To increase the attractiveness, the organizers of the Ponzi model often use Projects related to new technology products to attract investors.

No matter what kind of technology operate a Ponzi scheme What is, all forms of scams with this model have similar characteristics as follows:

- Commitment to bring high returns with little risk

- Stable profits regardless of volatile market conditions Why

- Investments are not registered with reputable authorities

- Institutions' investment strategies or forms are all called secret or are described with great difficulty

- Customers are not allowed to view Official documents for their investments

- It is challenging for customers to withdraw money from the organization

Ponzi scheme Conclusion

Here Kienthuccoin has helped readers understand what a Ponzi scheme is and it's telltale signs scam of this kind of pattern. This pattern is challenging to watch out for with various tricks, so anyone can be caught in this scam model without even knowing it. Therefore, it is essential to equip yourself with the knowledge to prevent it.

I Hope Kienthuccoin has brought helpful knowledge to readers about this famous scam model. Equip yourself with the basic knowledge about this model to avoid falling into the “trap”!

What are the frequently asked questions about the Ponzi scheme?

Who is the mastermind – Schemer – in the Ponzi scheme?

The mastermind of the Ponzi scheme was the one who set up the Ponzi scheme system and called for the first investors to join the system.

What is the task of Ponzi Introducing Investor in the Ponzi scheme?

Ponzi Introducing Investor is someone who only needs to spend very little or even no money to join the Ponzi system. The profit of Ponzi Introducing Investor usually comes from introducing investors to enter the system. The amount of money that Schemer pays for PII is taken from the investor's own money that PII introduces.

Who are the investors in the Ponzi scheme?

Individuals are willing to put money into the Ponzi system with the expectation of a high-interest rate without… doing anything.