Mục lục:

If you are a professional Trader, you cannot ignore the Binance exchange. Recently, Binance has launched a futures exchange with a huge leverage of up to 125x times. With this level of leverage will definitely bring huge profits. Let's find out what Binance Futures is with Kienthuccoin.

What is Binance Futures?

Binance Futures is a futures trading platform of the Binance exchange. With this platform, you can make a profit when the market goes up or down by guessing the price of a specific cryptocurrency without you necessarily owning the coin.

At the moment, Binance exchange has two futures trading platforms. The first platform is the Binance Futures platform. The second platform is Binance JEX, but JEX is quite “inferior” compared to Futures. With leverage of x125, the Futures platform is still the “money machine” of Binance.

On November 28, 2019, the 2nd perpetual futures contract – ETH/USDT was launched on Binance Futures. With this contract, the user can customize the leverage from x1 up to x50x.

Update 4/10/2020: The platform has been updated with many other perpetual futures contracts such as BCH, XRP, EOS, etc.

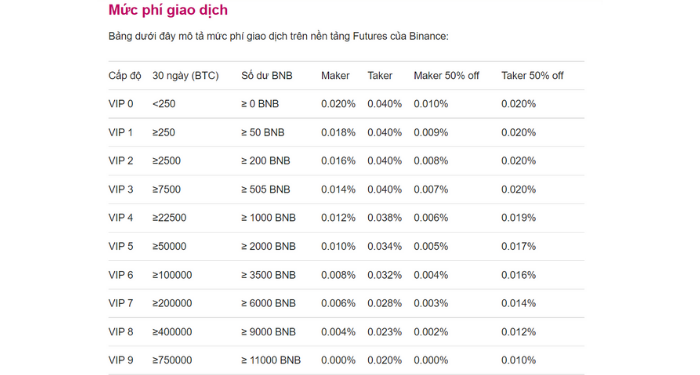

How much is the transaction fee on Binance Futures?

The table below describes the transaction fee on the Binance Futures platform:

Leverage

When opening a position, you have to pay an initial amount to maintain the position. The initial amount is called the Initial Margin. The maintenance amount is the Maintenance Margin.

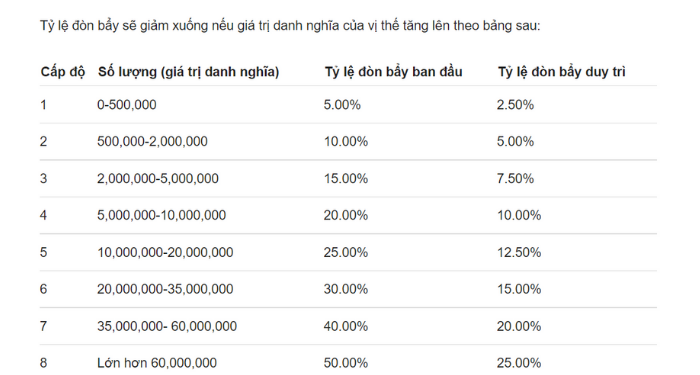

Leverage will decrease if the nominal value of the position increases according to the following table:

To understand better, please refer to the three examples below.

Suppose BTC price 10000 USDT and you have 40000 USDT in collateral and choose 125x leverage.

Example 1: You open 1 BTC, nominal value 10,000 USDT

- Initial Margin: 10,000 * 0.8% = 80 USDT

- Maintenance Margin:10,000 * 0.4% = 40 USDT

- Collateral: 40000 – 40 = 39960 USDT Liquidation

- price: 10000 – 39960/1 <0; you will never get liquidated

Example 2: You open 4 BTC, nominal value 40,000 USDT

- Initial Margin: 40,000 * 0.8% = 320 USDT

- Maintenance Margin: 40,000 * 0.4% = 160 USDT

- Collateral: 30000 – 160= 39840 USDT Liquidation

- price: 10000 – 39840/4 = 40

- Bankruptcy price: 10000 – 40000/4 = 0

Example 3: You open 6 BTC, nominal value meaning 60,000 USDT

With 125x leverage, the nominal value does not exceed 50000 USDT. To execute this order, you have to lower the leverage to lower levels.

Initial Margin

The Initial Margin is the amount you need to have when you open a wallet. For example, when the leverage is 125x. At this point, the real amount you have to pay to open the position is 1/125 of the value of the contract.

Maintenance Margin

Maintenance Margin is the amount you must maintain in your margin account after opening a position. To avoid auto-liquidation, you should actively liquidate before the collateral falls below the Maintenance Margin.

Funding Rate

This is the amount the buyer (Maker) will have to pay the seller (Taker). Funding will be done once every 8 hours at 0.01%, i.e., 0.03%/day.

This 0.01% level is subject to change depending on market conditions. This is a direct transaction between two parties, so Binance does not collect any money.

Note: Funding Rate will never exceed 0.05%.

Assessing the advantages and disadvantages of Binance Futures

Currently, users can use Binance Futures on the Binance app running Android and iOS.

Advantages

- Offers high leverage up to x125x- Highest in the crypto market.

- Large trading volume easy liquidity.

- Simple interface, easy to see, easy to use

- Can use Binance account without the need to open another account

- Can trade on Binance Android app.

Cons

- Difficult to use for beginners.

- There are still quite a few trading pairs left.

Instructions for trading on Binance Futures

Open a Binance Futures account.

On the website

Step 1: Visit Binance.com; if you don't have a Binance exchange account, you can create one: https://www.binance.com /

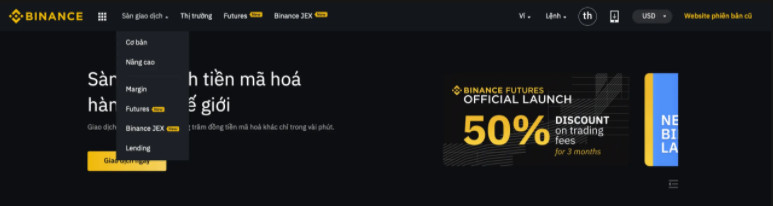

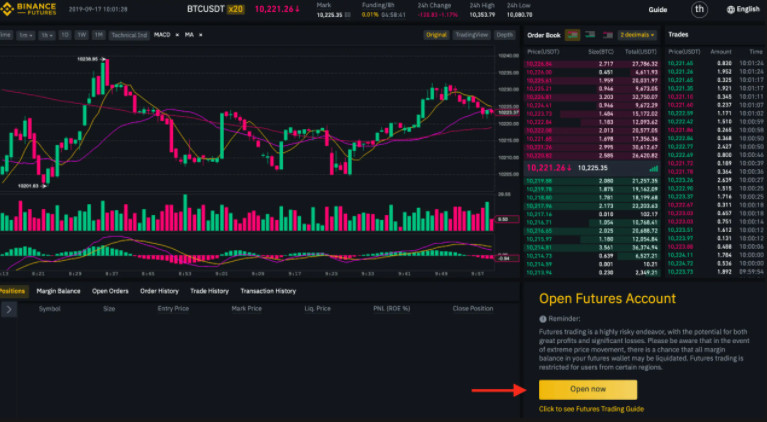

Step 2: After logging in to Binance, choose Exchange and go to Futures

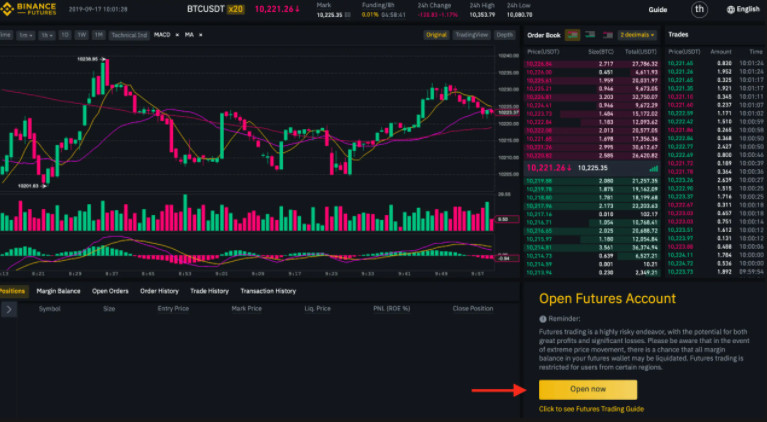

Step 3: Select Open Now to start opening orders

Step 4: You will see the Open Success notification icon in the upper corner of the screen. So successfully opened account Binance Futures.

On the Binance App, Go to the “Funds” section and then click on Futures. Then click the button Open Futuresto have a Future account.

How to transfer money to Binance Futures

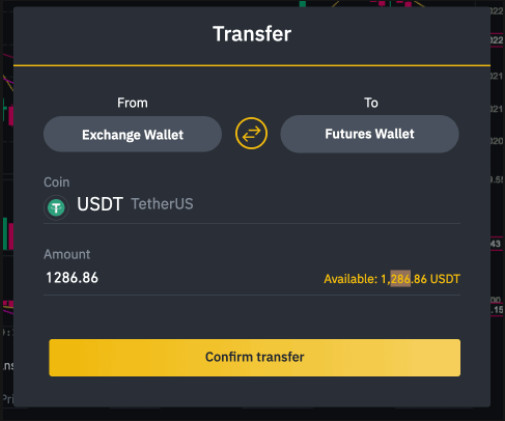

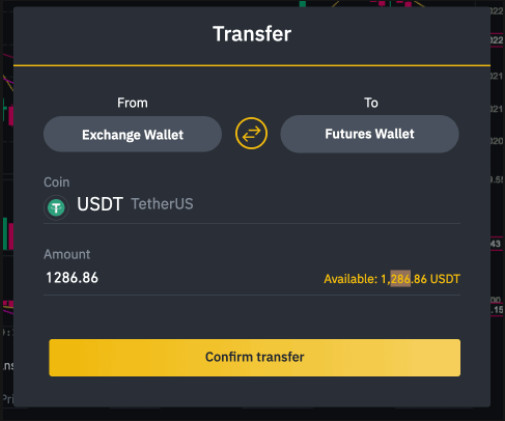

Step 1: You need to transfer money from Binance exchange wallet (Exchange Wallet) to Futures wallet (Futures Wallet), click Transfer.

After clicking Transfer, it will appear as shown below. You enter the amount in the “Amount” section and then click Confirm Transfer. So I have moved from the exchange wallet to the Futures wallet.

How to place an order on Binance Futures:

Basic terminology when placing an order:

- Post-Only: This is an order that will be added to the order book but not executed immediately

- Time in Force (TIF): Effective time.

- Good til Cancelled (GTC): This order will be completed until matched or will be canceled

- Immediate or Cancel (IOC): This order will be partially or fully executed immediately; the rest will be canceled.

- Fill or Kill (FOK): The order must be filled immediately or canceled.

- Reduce-Only: This order will only close your position, not increase it.

- Trigger: is the price that will trigger Take-profit-limit, Take-profit-market orders

- Mark Price: Price calculated by Binance based on the price group of significant exchanges and Funding Rate.

- Last Price: The final price traded on Binance Futures.

- Cost: The amount of USDT you need to enter a LONG/SHORT order.

- Order Qty: Order quantity.

Limit Order

This is an order used to Buy/Long or Sell/Short at the desired price.

Example: You want to Buy/Long 1 BTC for 9000 USDT. You need to enter 9000 in the “Price” field and 1 in the “Order Qty” section. Finally, you just need to press the button Buy/Long. You can choose Post-Only or TIF depending on the purpose. Same for Sell/Short orders.

Market

Order This command helps you to LONG/SHORT quickly. This order will match the best price available in the order book.

Example: Market price 9000 USDT/BTC. If you think BTC is still increasing and you Buy/Long 1 BTC at the current price, you just need to enter one at “Order Qty” and press the button Buy/Long.

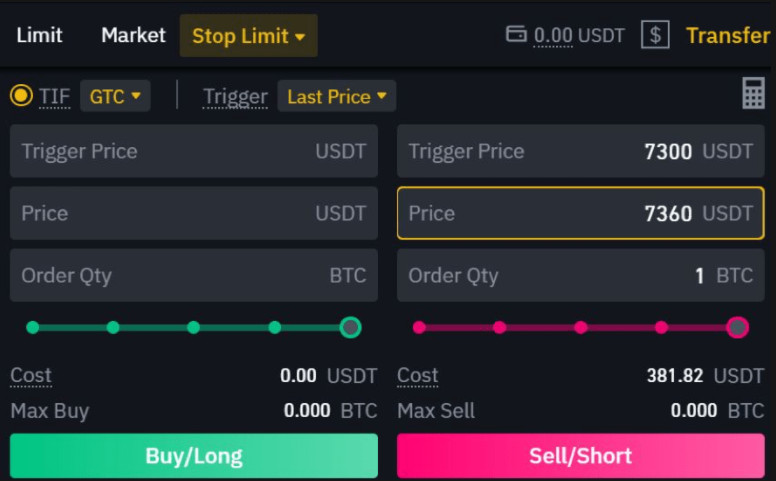

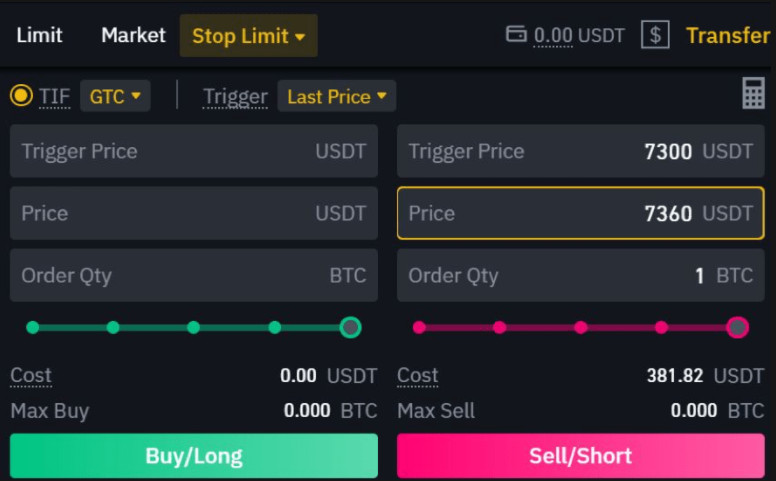

Stop-Limit Order

This is an order that will trigger a limit order when the market price reaches the Stop Price.

Example: Price of BTC 10000 USDT. You place a Sell/Short Stop-Limit order. The Stop Price is 10200 USDT. Price limit 10215 USDT. Amount 1 BTC. When the Bitcoin price goes up to 10200 USDT, there will be a Sell/Short order at 10215 USDT placed for this 1 BTC.

Stop-Market

Order This order will trigger a Market order when the Stop Price is reached.

To enter this order, put your mouse on the arrow in the Stop-Limit section and then select Stop-Market. Same for the rest of the commands.

For example, the BTC price is 10000 USDT. You place a Sell/Short Stop-Market order. Stop-Price is 10100 USDT. Amount 1 BTC. When the market price reaches 10100, a Market order will be set for 1 BTC at the market price.

Take-Profit-Limit Order

Same as Stop-limit, but the price will move in a favorable direction. This order is used to place a target in an open position. Don't take profits and close positions.

Example: Current BTC price 10500 USDT. Trigger Price – 10100 USDT, Price – 10050 USDT. Amount 1 BTC. The user chooses Sell/Short. If the BTC price reaches 10100 USDT, there will be a Limit Sell/Short order for 1 BTC with a limit price of 10050. People should set price <Trigger Price to increase the chances of being triggered.

Take-Profit-Market

Order This order is similar to Take Profit Limit but without a limit price.

Example: Current BTC price 9000 USDT. Trigger Price 10000 USDT. Amount 1 BTC. The user chooses Buy/Long. If the BTC price reaches 10000 USDT, there will be a Market order for 1 BTC placed at market price.

Conclusion about Binance Future:

Leveraged investment can bring big profits, but the accompanying risks are not small. Hope the article “What is Binance Futures? Kienthuccoin's “Binance Futures User Guide” helps you better understand the Binance perpetual futures exchange.

What are the frequently asked questions about Binance Futures?

Is it safe to invest in Binance futures?

The Exchange on the Binance system – one of the prominent and reputable names in the virtual currency market, so you can rest assured when investing on this platform.

Is it possible to transfer money from Binance futures back to Binance exchange?

You can do this. You just need to change the From and To positions at the conversion step or click the two-way arrow in the middle to swap places. Then, you can transfer money from Futures Wallet back to Exchange Wallet.

Should I participate in Binance futures?

Any virtual currency exchange contains both profits as well as risks. You can earn huge profits from trading on Binance futures, but the risk of failure is also extremely high. Therefore, you should make sure that you know the game's rules and can tolerate losses within the allowable amount before investing.