Mục lục:

Before clarifying what is Binance OCO order? Let's learn about Limit order and Stop-Limit order with Kienthuccoin because they are closely related.

What is Limit Order?

A limit order is an order that we usually use to sell or buy a particular cryptocurrency on the exchange at the desired price.

Why use limit orders?

Cons of Limit Orders

- Difficult to sell or buy when the market isn't managing the risk of entering an order

Example

The current price of BTC is 10380 USDT, but if you want to buy at 10000 USDT, just Place an order and wait for the order to be matched to have successfully bought BTC.

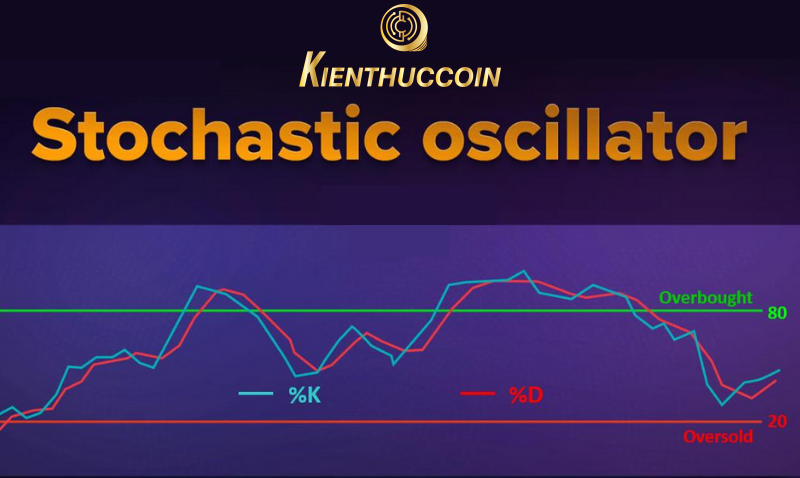

What is a Stop Limit Order?

A stop-limit order is an order to sell or buy a cryptocurrency when it reaches a certain price range, the price of which is called the stop price or stop-price.

It is essentially the same as Stop Loss.

Why use Stop-limit order?

- Avoid situations where the price suddenly drops too much.

- Easy to manage capital

- Manage risk when entering trades

Disadvantages

- Easily confuses limit price (Limit-price) and stop price (Stop-price)

- You can't sell the desired price while placing an order.

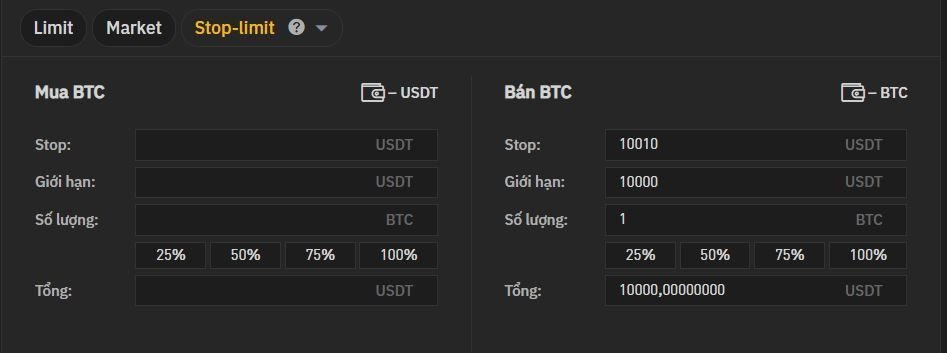

For example

Current BTC Price 10380 USDT and your risk is 380 USDT for 1 BTC. Then you just need to place a stop-price order (Stop-price) of 10010 USDT, and the limit price is 10000 USDT

*Note: Because the cryptocurrency market fluctuates quite high when placing a stop-limit order, it is necessary to set a Stop-price that must be slightly different from the Limit-price to avoid the case that the order cannot be matched.

What is a Binance OCO order?

What is an OCO order? OCO order stands for (One-Cancels-the-Other), a combination of limit order and stop-limit order. When one of the two orders is activated, the other will be canceled.

Binance OCO Order? A Binance OCO order is an OCO order executed on the Binance exchange.

Why use the Binance OCO order?

- OCO order helps you take profit and stop loss with just one order.

- OCO orders overcome the disadvantages of both limit and stop-limit orders.

- Easy command management.

- Limit risk when entering orders.

What are the disadvantages of OCO orders?

- price levels

OCO order example

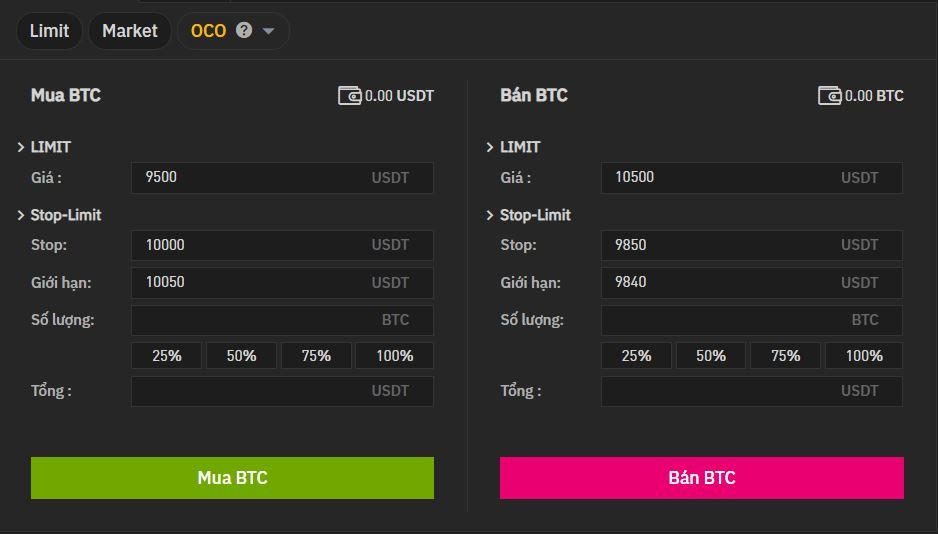

- Use case for a buy order: BTC price is currently 9700 USDT. You want to buy BTC at 9300 USDT, and at the same time, you will also buy if BTC breaks through the resistance level of 10000 USDT (you believe BTC will go higher if it breaks the resistance level).

- Sell order use case: BTC's current price is 10000 USDT, and you want to sell BTC 10500 USDT, and at the same time you will sell BTC will fall if 9900 USDT support level is breached (you believe BTC will fall sharply if breached the level support).

*Note:

- Sell order: Limit price>current price>stop limit price.

- Buy order: Limit price<current price<stop limit price.

Instructions for using the Binance OCO order

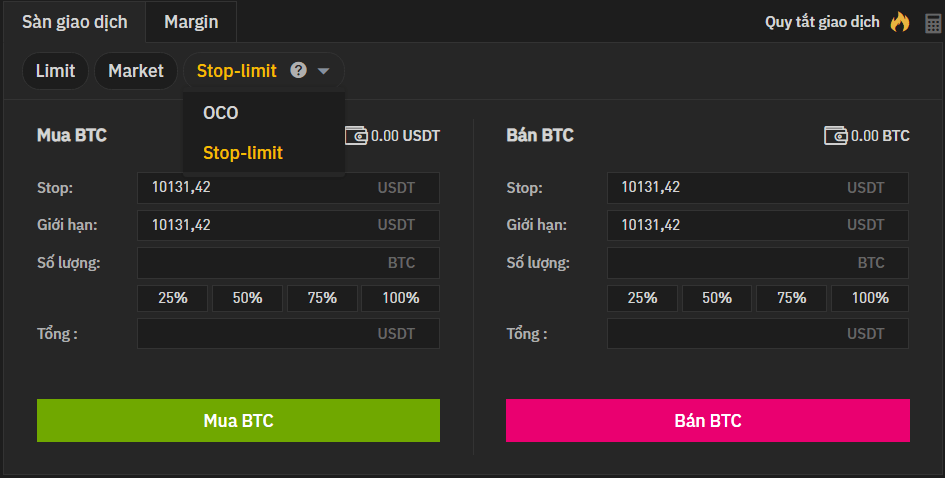

After logging into the Binance exchange and in the Basic Exchange mode, click Stop-Limit. Here you will see OCO, select OCO, and already place an order.

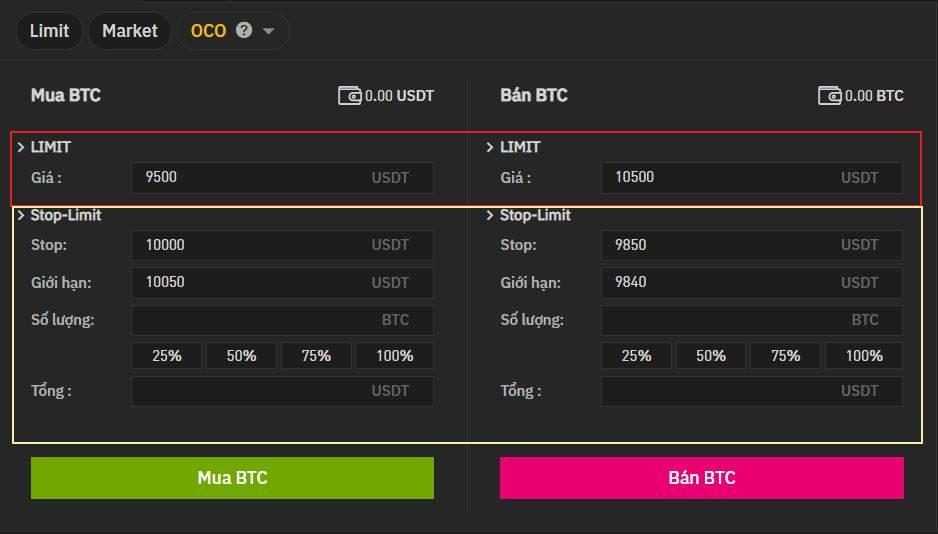

As mentioned above, a Binance OCO order will be two orders, including a limit order and a stop-limit order. The price for the OCO order should also have two parts:

-The upper part is like a normal limit order

-The lower part is like a stop limit

When the order is placed successfully, the message will be displayed below.

When placing an OCO order, Binance will get two orders, as shown below

Conclusion

Above is Kienthuccoin's article about “What is a Binance OCO order? How to use OCO order on Binance”. I hope the report will give you knowledge about OCO orders as well as how to place OCO orders on the Binance exchange.

Frequently asked questions about Binance OCO orders.

When to use Binance OCO orders?

You can use OCO orders on Binance as a way to automate your trades and help you maximize profits and reduce losses. However, when using the OCO order, you need to ensure that you have mastered the operation of Limit and Stop-Limit orders. Do not confuse the prices when placing orders.

When to use limit orders?

Limit orders are often used when you don't need to place a quick order to sell or buy. Besides, this command is also used if you determine a good entry point after carefully considering the factors of fundamental analysis and technical analysis. Limit order – Limit may not be executed immediately if the price has not touched the point you set. You have to wait for the price of that cryptocurrency to return to the desired area to execute the order.

When should a stop-limit order be used?

Stop-limit orders help traders manage risk in trading. With this order, you can easily cut your losses when the price drops sharply or take profits when the target price is reached. In addition, stop-limit orders can also be used to place buy orders when you see a resistance level of a certain coin has been broken.