Mục lục:

What is Trade Coin? Strategy and principles Trade coin from A – Z

Want to become a professional and make a profit from Trade coin? You first need to learn, read and start working to draw a lot of “blood and bone” experience for yourself. But first, let's understand what a Trade coin is? What trading strategies and principles are there?

What is Trade Coin?

Trade coin is a form of buying and selling coins on exchanges to make a profit. Coins here are cryptocurrencies such as Bitcoin, Ethereum, …. These coins fluctuate very enormously, you can make a profit during the day.

In other words, players often buy coins when the price is low and sell when the price increases, thereby making a profit on the difference. To understand the cost of any coin, you need to know the Bitcoin situation first.

Steps to join Trade coin for newbies

Step 1: Prepare a

- Bank Account (Vietcombank is popular) to buy cryptocurrencies on fiat

- exchanges Exchange account in VNDwallet

- Cold If you want long-term storage (HOLD)

- Accounts on large exchanges have good liquidity if you're going to trade coins.

Step 2: Proceed to buy coins from VND

You can buy virtual currency, coins from exchanges that support trading in VND, such as:

Note you can choose Binance P2P to trade coins on Binance exchange which is always very convenient!

Step 3: Send coins to the exchange to trade

Some reputable coin exchanges and cheap transaction fees:

Standard terms used in trade coin

- Dump: This means a sharp drop in price

- Pump: Price

- Stop-Loss (SL): When buying a coin but for a certain time, the price does not go up, instead, the price drops continuously, you feel it will continue to decrease, you should stop loss. Accept the loss and wait for the opportunity when it touches it, then buy again, when the price increases, will become a

- Take profit (TP): That is, feel that the profit is enough and think that it will decrease, then sell

- What is Resistance: The place where the price can go down

- What is the Support: The place where the price can go up again when the price runs up.

- Volume: Trading volume, if you buy, there will be sellers. When the sale is completed, it is called a successful transaction and counts as a Volume.

- Long: Buy coin (Used for margin)

- Short: Sell coin (Used for margin)

- Margin: This is a form of Trade coin using leverage, usually is 2.5 times; that is, the exchange will lend you 2.5 times the amount you have. When you have 1 BTC that you trade in the margin, you will have 2.5 BTC to trade.

Effective Trade Coin Experience

Want to Trade Coin professionally and effectively? The most important thing is “experience.” Here are a few minor experiences during the time I trade coins and feel it is effective, so I should share them with everyone:

- If you have little capital, you should choose junk coins to trade, not trading BTC will make little profit. When you have a capital of 1 BTC or more, then Trade BTC.

- For high-priced coins like ETH, DASH, MXR, it will usually follow BTC.

- Bitcoin will dominate garbage coins, so Junk coins will go up when BTC decreases and vice versa.

- In some cases of Bitcoin encountering bad news, users can invest via Ethereum, DASH coin, Monero Coin, then this type has a high price. You must judge the psychology of investors.

- It would be best to remember that virtual currency exchanges can always manipulate prices and adjust prices up and down as they want. In addition, those with significant capital can also more or less do the price. You have to judge the intention when you see the coin rising and falling sharply. This part requires a lot of experience in trading coins.

- New to Trade coin, only play junk coins, the advantage is low price, low investment, mainly for the experience.

- One of my biggest experiences is “practically” losing money is stupid, you try to lose about $1000 as you will see a lot more wisdom.

Strategy trade coin is simple for beginners

To trade coins successfully has never been easy for “probationary” traders. Here are trading strategies for newbies. Before starting to trade coins, it is essential to consider how much you are willing to risk carefully. Remember, cryptocurrency markets are extremely ‘volatile,' so it is necessary to be as cautious as possible to profit.

Long Hold

The most straightforward strategy on this list is the “long hold” strategy, simply because it requires very little knowledge to succeed.

The rule is simple: buy a coin you feel has a promising future and hold it for a few months or years before selling it.

In the long run, most of the top cryptocurrencies will experience both sharp declines and substantial gains. It is not recommended to check the price often as this can lead to you stepping out of the market too soon when it is only a temporary drop.

Example 1

You can buy Bitcoin from any popular Bitcoin exchange with fiat money and check the price after five years (for example).

Unlike other strategies, it is not necessary to have to check the price frequently.

This action should be avoided to prevent you from getting swings and selling prematurely because of transient price movements. Instead, you should only test the price after a long period – then you can sell if you have achieved the gain you are looking for.

Hold is undoubtedly not the most effective strategy on this list, and there is no guarantee that cryptocurrencies will continue to grow in the future. Furthermore, it is not always optimal to buy now, as cryptocurrencies are frequently subject to sharp fluctuations in short periods.

Because of this, you can improve your ‘long hold' strategy a bit by using ‘average cost.'

Example 2

You want to buy 2 BTC, don't buy both at once, but buy one at a time.

In the first batch, you buy 1 BTC for 7,000 USD, then after a few days, buy another for 6,400 USD, the average cost to pay per BTC will be 6,700 USD.

The average cost is intended to protect you from a massive price crash right after you invest. This can provide you with some protection against significant market fluctuations.

In any case, when contemplating investing in a coin, especially for novice traders, we recommend doing some fundamental analysis first. This means checking if the coin really has a reason to grow.

Day trading

In stark contrast to the “long hold,” a “day trading” strategy is the act of buying and selling coins on the same day or multiple times a day, taking advantage of small price movements.

“Day trading” has the potential to be highly profitable if done correctly due to the inherent volatility of cryptocurrencies. However, “day trading” is riskier than “long-term holding.”

Because of this, when “day trading,” it is essential only to use the amount you can afford to LOSE. Take care to set up a proper STOP ORDER to prevent any severe losses.

In the crypto world, things move very quickly and unpredictably. Many coins can experience price fluctuations of up to 5% over a day simply due to small changes in supply and demand.

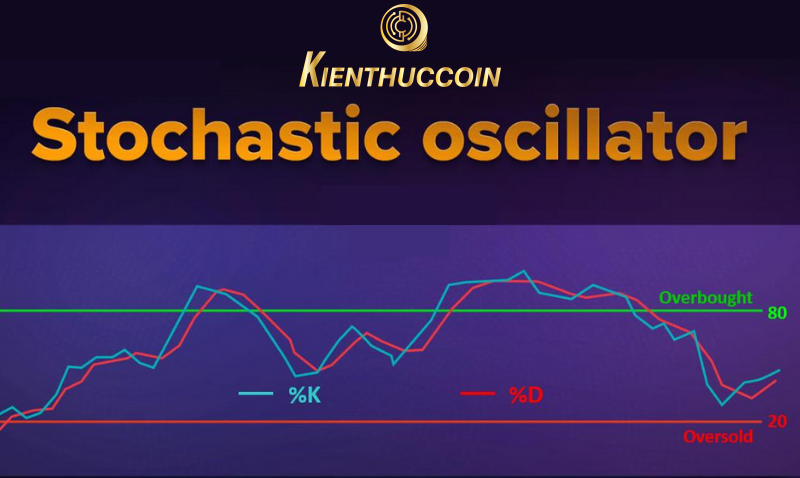

There are many useful technical indicators that you can use to find good entry points for your trades. Includes moving averages (EMAs), Relative Strength Index (RSI), and moving averages (MACD).

Scalping (surfing)

The scalping strategy is quite similar to the “day trading” strategy, a fast-paced trading strategy with the ability to generate profits quickly. Of course, faster-paced is also riskier and should only be done on high-volume coins. Scalper should choose exchanges with the lowest transaction fees.

With the “Scalping” strategy, the trader will open a position and then close it during that trading session; in other words, they never hold a position overnight.

Whereas with a “day trading” strategy, traders can look for opportunities to enter the market once or twice, even a few times in a day. But the frequency of entering the market of a scalper (surf trader) is very high, and they try to get small profits many times in a session.

Scalping essentially allows traders to take advantage of the spread a coin sees over short timeframes, such as one, three, or five minutes. Currently, almost all cryptocurrencies with significant trading volumes are volatile. The only exceptions are stable coins like Tether (USDT) and True USD – which tend to be much less volatile.

To make your coin trading easier, we recommend using only major crypto exchanges. Stick with the top 30 cryptocurrencies on Coinmarketcap.

Smaller price movements usually happen much more often than large ones. Fluctuations from 0.5% to 1% per minute are common – even during periods of low volatility. Through this, scalpers can make a profit every day, regardless of whether the market is up or down.

Scalping is one of the exciting strategies used for trading. However, it is also one of the riskiest strategies. A significant drop could quickly wipe out all your previous gains. Therefore, scalpers should not ignore the stop-loss order.

For more help, you can use volatility indicators for this strategy. The simplest way for the novice trader is the Bollinger Bands. Furthermore, you can also use the same range of price (ATR) or the Volatility Index (VIX).

Volatility is highest when the upper and lower Bollinger bands are far apart; Volatility is lower when they are close together.

Swing Trading

Swing trading is done over a longer time frame, usually a week or two, to capture bigger profits on a longer time frame than day trading and scalping. This makes it an ideal strategy for beginners.

You are mainly interested in daily and weekly charts, and it takes less time than scalpers and day traders.

Pay attention to technical indicators and fundamental analysis to determine whether a coin will experience a significant price swing or gain enough momentum to change the trend. Therefore news is especially important for cryptocurrencies, as negative or positive news can easily change the trend of a coin.

When swing trading, it's important to stay up to date with the latest developments in the community, as it can affect the price action of your options. Indicators like RSI or MACD can be really useful when used in frames.

Trade coins based on RSI

Trading based on the Relative Strength Index (RSI) is one of the popular strategies among novice traders. The RSI is a simple momentum indicator that measures the speed and variability of price movements. Recent to help identify overbought and oversold markets. Most traders will usually set the RSI between 30–70. If the RSI falls below 30, this means that the coin is oversold => the price may recover shortly after that.

While an RSI above 70 could indicate an overbought coin => potentially leading to a sell-off.

To better understand the RSI, we will look at the example of Bitcoin (BTC):

The RSI (purple line) was widened at midnight and briefly penetrated the 30 mark several times before the price rebounded. Just a few hours later, the RSI hit 70, and the cost of BTC was gone. Into a downtrend.

This may seem like an infallible strategy, but don't be fooled. Because of this, the most important thing is to set up your stop loss just below your entry price, which will allow you to exit your position if the RSI continues to fall.

If your stop-loss order is triggered, you can further watch the next move of the RSI and other strength indicators. To determine if you should re-enter at a lower RSI to prepare for the next spike.

Note: When referring to the 4-hour or daily charts, you should look out for the RSI to identify oversold or overbought.

Avoid pump-dump groups

As you continue researching trading strategies, you will almost certainly come across something called a ‘pump-dump' group. These groups tend to provide viewers with extraordinary returns based on false or often misleading claims.

Typically, pumps will attempt to hold a large number of orders on a particular asset to increase the price of that coin. At that time, the price will spike sharply, and traders often rush in to make a profit, but when it reaches a certain point, the ‘pumps' will discharge (sell-off) the coin, at which time the traders will eat enough.

16 fundamental trading rules for beginners

Here are 16 principles and a bit of experience in trading coins that you need to keep in mind to minimize losses.

Principle 1: Determine the level of investment capital

Determine the capital spent as idle if lost does not affect life and start with a minimal amount.

Principle 2: Set goals

- TRADER (buy-sell surf)

- HOLDER (long term hold)

- TRADER & HOLDER

Principle 3: Identify the coin market

The coin market is divided into three segments:

- Low risk: Top coin 1-4

- Medium risk: Top coin 5-11

- High risk: Coins with good information but with small capital.

I will call them 3a, 3b, 3c respectively for Low risk, Medium risk, and High risk in the next sections.

Principle 4: Proper capital allocation

If possible, 100% of capital should be divided as follows: 60% into 3a + 20% into 3b and 20% into 3c.

So segment 3a will be Long-term, segment 3b is Mid-term, and segment 3c will be surfing.

Note: Don't listen to everyone but invest all in 3c, if you're lucky, the account x2, x5, x10 … but the possibility of losing everything will be very high. “Greed is deep,” I'm slow but sure, I don't need a lot of words, I hope I don't lose capital; when you lose money, you will fall into misery!

For example, Your capital has 100$ if slowly you will have x2 accounts. Now you have $ 200, but if you are in a hurry to lose 50% of your capital, that means you only have $ 50; the difficulty starts here. Now you want to have $ 200, and you must have x4 accounts. Not easy at all.

Principle 5: Mistakes when choosing coins

Newbies often mistake choosing cheap coins that they buy just for it, hoping it's fast x2, x10 but ignoring information is wrong because these coins will kill those who don't understand quickly.

For example, Coin A costs 0.1 BTC, and coin B costs 0.000000050 (50 satoshi); and have you ever thought about what will happen if A and B both lose one satoshi???. A decrease of 1 Sat is nothing but B decrease of 1 Sat means that your coin wallet B has decreased by 2%, horrible, right???

Principle 6: Intensive capital management

After you invest according to the principle of 3a, 3b, 3c, in each investment, you should not use all your capital for one order to buy or sell all your coins in 1 sale.

When buying and selling, you have to combine more news and technical analysis. According to experience, the seniors go ahead with 20% technical analysis and 80% news; Therefore, when the market has no significant information, it is mainly based on technology and vice versa.

If the initial capital is too small to be divided like that, you should choose 3a or 3b only, and HOLDER is the main; the chance of 3a winning is over 85% but slowly. And remember not to buy high and sell low!

Going back in time a little bit, in the past, anyone who played FOR – SEARCH must know that the high-interest rate is 30% / month, which means that in 100 days, you will have x2 accounts, if you continue to play, 100% of your capital is still working risk.

In the stock market, there are stocks that you keep from 6 months to 1 year, which is normal, IPO is even longer…

Trade coins today, you should not be too impatient, it will ruin things! Don't see other people win big and get greedy! Sometimes I have to review myself if I want to make a profit in the morning and afternoon (if possible, it's too good). Is it too much and too greedy?

Example

More than ten days ago, some of you bought XRP at 130, even 150 or 170, until the price ranged from 100 to 103.

But because XRP is the top 3 as a 3a investment, you can rest assured that within no more than 100 days, you will stop collecting capital and profit from at least 50-100% depending on the purchase price!

So, in short, if you want to make money and preserve your capital, you must know how to wait for the right opportunity. As for the 3c group, on the contrary, beat it quickly, so newbies should not play too big in this segment.

Principle 7: Technical analysis

Firstly, you must know how to read Japanese candlesticks, resistance points, support points, and support zones.

Bollinger Bands, if you like, add MACD (who knows more, just analyze, if not, see an analyst and then reassess).

You can go to youtube to find out and choose an easy-to- and easy-to-understand clip. When analyzing too long, the opportunity will fly away, careless analysis will pay the price!

An essential issue in the analysis is to pay attention to the time frame 15 minutes, 30 minutes, 1 hour, 4 hours,…, one day … will give different value in the short or long term.

Principle 8: Identify news and rumors

We need to distinguish the difference between news and rumor, news is a confirmed fact, once fake news is a rumor. When you receive news, you should find out for yourself and analyze whether it is news or rumor.

The first is to check if the news reporter, original news, and original messenger are reputable, see more in other forums and comments on this news, and don't forget to check the time of posting. A reputable person will have many Views, Likes, Follows, Subscribed and many good comments or vice versa, but if you know well about the original post, there is nothing better.

Sometimes a rumor that many people accept will be good news in the short term (surfing). Recently, there was a top 10 coin about to be listed on Okcoin, and as a result, that coin has nearly tripled from the bottom price! After Okcoin confirmed the fake news, this coin still kept near x2 because it was the top coin (if it were another coin, it would drop deeply).

Also, you should not listen to the instigation of some pump groups, especially junk coins (small volume), this is a rumor of 1 or some self-seeking people that people like you will be victims. . If your knowledge is limited, you should only invest in groups of 3a and a little 3b.

The following example will immediately grasp the problem:

- Coin Y has a price of 5 Satoshi.

- The volume is 100 BTC.

- The group informs you that tonight at 7 pm, WHALE will be pumped to the moon.

Thus, the “bookmaker” in the Pump group only needs to have around 30 BTC in hand and start buying coin Y slowly, until almost 19:00 they buy in large quantities pushing the price to about 10-20%.

At that time, people believed that WHALE had appeared, thought it was real, and started buying. Suppose in your group there are 500 people, some people participate a lot, some people are few and some don't… on average, each participant is 0.2 BTC, so the total capital put into coin Y = 0.2BTC x 500 = 100BTC, right Immediately the price increased by more than 100%.

While 500 brothers are enthusiastically buying, does anyone know that the number of Y coins they are buying is mainly from the “banker” released for you to collect? The house is safe and has doubled the account. What will be your fate? We stomped on each other to live and killed our fellow students… whoever got out early got a profit of 50%, 40%… 10% or luckily breaking even, most of the rest was dismembered.

So the number of people with a bit of profit still believe that the WHALE pump is real. The rest blame themselves for entering the order too late. Most importantly, the “house” reputation is intact, and 500 brothers continue to be used in subsequent games. The numbers in the article are illustrative, if this Group Pump has a few thousand people, the consequences will be even more terrible.

In short, pump news (not 100% wrong) must be checked, re-checked many times for its truthfulness, and importantly should be received from traders who have the “heart” and final decision. is in you.

After confirming how much honesty and needing to combine with a bit of technical analysis, news and rumors are that you can confidently fight alone.

Principle 9: Mentality | Trade Time Fund | How to enter and give orders

Mentally, you have to be strong, to do so, you need to know the knowledge. When the market fluctuates sharply, it is necessary to determine temporarily where the top and bottom are, choose immediately at what price to buy, and directly sell at what price, when deciding to buy – sell or hold for a long time and select whether or not regrets!

Trade time fund: should spend a reasonable amount of time on each way of playing TRADER or HOLDER. In addition, spend a lot of time learning about the coin you have and will hold.

Enter a SELL / BUY order: you need to determine how much capital to invest in that order, do not enter according to emotions, for example, the amount of 10, 100, 1000 … will not control the effect or damage caused by that order. You must specify this order $10, $100… or 0.01 BTC, 0.05BTC, 0.1 BTC… until the profit (loss) is 10%, 20% … still know how much the effect or loss is. Sometimes you keep up to 10,000 coins A when the price doubles thinking that you won big, it turns out that 10,000 coins A costs only 2$, for example!

To enter a SELL / BUY order, you should turn on Bollinger bands and determine the temporary top and bottom price. When you want to buy, you should set a little higher than the bottom price (can determine more bottom 1, bottom 2 …); Similarly, when you want to sell, sell a little below the peak price (can identify more peak 1, peak 2 …). In short, you can buy multiple batches and sell many different batches.

Principle 10: TAKE PROFIT & STOP LOSS

In advance, you must determine this problem when entering a potential trade, how much % will win and how much % decrease, then stop loss (combined with long or short-term strategy). Maybe you set a goal of 10% increase then close and 10% decrease then cut, this will be true but not enough.

Usually, you look at Bollinger Bands to see if the price is a top or bottom (short term and long term) and follow current news to see if it continues to be good or bad and make a decision.

The floor fee is not small, not big, but you have to know it well, some traders go in for a while to see the negative account because of this wrong charge. For example, Bittrex exchange charges 0.25%, then you have to charge a fee for 1 trade of 0.25 x 2 = 0.5%. When entering a Sell order, it must be greater than 0.5% to be profitable. Easy-to-understand quick calculation tip: if you take profit and cut your loss by 8%, for example, just take the buy price x 92% or buy price x 108% for immediate results. Unless you have to land quickly to preserve capital, surfers should take 5% or more profits, too low to do everything for the floor.

Example 1: The price has bottomed, and this drop is merely a correction, besides there is no bad news, so why stop loss even though it has dropped by 10%?

And if it is inevitable that it will fall further, sell, cut loss and buy back at a lower price. In addition, if you have capital conditions, you should apply the DCA method (average price).

Example 2: Buy one coin A bought at 100$, now reduced to 80$, then you buy one more A so that you will have two coin A at the average price of 90$…and so on if you have faith in A. When you sell, you also break down the selling price, increasing from the price you feel is acceptable to make a decision.

Principle 11: Bull Trap | Bear Trap | Account fire

Sometimes you will see one coin increase quickly and drop in horror (and vice versa). This is when WHALE sets a trap. Those who lack experience, knowledge, and weak psychology will fall into a trap, either buying at a high price and then falling, or selling at a very low price and watching the coin that has just sold skyrocket.

Usually, the men who play margin and play big when their account is burned also have the same phenomenon, the price in an instant falls deeply and then rises again. Therefore, when the market fluctuates, and it is predicted that many accounts will burn, placing an order to buy cheap hunting will have many surprises!

Principle 12: BUY WALL | CELL WALL

Buy and sell walls are where the buy or sell price is locked in a large enough or huge quantity. Usually, this information is for reference only because you must know they will place these block orders when the giants want to scare you into falling into their trap. You must understand that this order has the right to cancel — any time before order execution.

Therefore Buy Wall or Sell Wall can be real or virtual. I only refer to this indicator and have about 20% or less value in the decision.

Principle 13: SCAM and what to know

All your accounts: email, Facebook, Zalo, telegram, trade accounts, blockchain wallets, bank accounts, including your laptop, phone, and your standard SIM… are all money, so must ensure maximum security and protection, turn on 2-layer security, absolutely do not be foolish to provide any information about your account or message on your phone even if you need help from others => All are all scams.

No matter how successful your trade is, it's only zero when you get scammed, and the obsession is unforgettable! Be very careful when bringing your phone, Ipad, or laptop out for repair.

Principle 14: Distinguish between news and rumors in their raw form

I have a lot of unfiltered raw news and rumors from abroad. I need you guys to cooperate in analyzing more to help everyone win, too much to learn alone. The original is in English on reputable websites and tweeters of some CEOs of some coins. Everything is completely free because you know more, you have more income, and I have nothing to lose!

In English, you don't have to worry, open the CHROME browser and then right-click to translate it into Vietnamese, but it's important to understand the article. It's very confusing when the news forecast decreases, but you know that it is increasing, what will happen? Will come! This one myself is often confused because no one knows whether it is increasing or decreasing!

Principle 15: BTC Price Movement

Trade coin should pay a little attention to the price of BTC because when Bitcoin fluctuates, the Altcoin market is more or less affected. There is no clear rule that it is positive or negative with BTC, with more than 700 coins, there will be ups and downs, just keep in mind that it is dynamic so as not to panic and calm down. What to do next or simply wait.

Principle 16: The Last Important Rule

You have the right to see what others say, analyze what … but believe it or not, it is up to you. Should watch for reference + your knowledge = income.

Dump or Pump news is valid for how long and should be considered short and long term. Many of you buy in the morning and then fall back complaining… the next day it goes up again… Or buy the next day it goes up 5-10%, and you don't know the review won't surf, so the next few days it will be deeply reduced! Also complaining!

You should create knowledge for yourself. It is very dangerous to create a fishing rod for yourself and go fishing, but not every day, begging for a fish to eat is very dangerous.

Limits should not ask someone what to buy and sell! And I can't answer such questions myself!

News and rumors are double-edged swords that can help you today and kill you tomorrow if you don't know the filter!

Conclude

Each trader will have a separate trading strategy, the ultimate goal is still to make a profit. Therefore, deciding whether to trade coins or not is completely dependent on your risk tolerance. But if you have decided to trade coins, then invest your knowledge seriously. Cryptocoin24h hopes to provide you with a lot of useful information.

FAQs about Trade coin

What is a trade coin exchange?

Coin exchange is a place for traders, coin players to make cryptocurrency transactions. In a word, the coin trading floor is seen as a market in which players will buy and sell.

There are many coin trading platforms, according to statistics, currently, there are about 3000 exchanges with different popularity, reputation as well as transaction fees. Now, there are 2 exchanges used to trade coins the most: Bittrex and Poloniex.

Should I Trade Junk Coins?

Junk Coins are often of very low value and are being dominated by Bitcoin (BTC): Bitcoin drops, junk coin prices, and vice versa. Because of the low value, when Trade Coin Junk, the trader does not need to have a large capital. On the other hand, when pumping, the price of Junk Coin will increase a hundred times, so the return on investment is very high. That's why many professional traders are still surfing Junk Coin. In addition to the top major Trade Coin exchanges such as Poloniex, Bittrex, Bitfinex… some prominent Junk Trade Coin exchanges are NovaExchange, Livecoin, CoinExchange, Cryptopia, and Etherdelta

Is Trade Coin a scam?

The nature of Trade Coin is not a scam at all; although it is said to be an investment, Trade Coin is no different from a “game,” many people also call it “knowledgeable gambling,” risk has the opportunity to earn. There is also a lot of money, whether it is Trade Coin or long-term investment; of course, there will still be risks you should determine before participating in this cryptocurrency market.